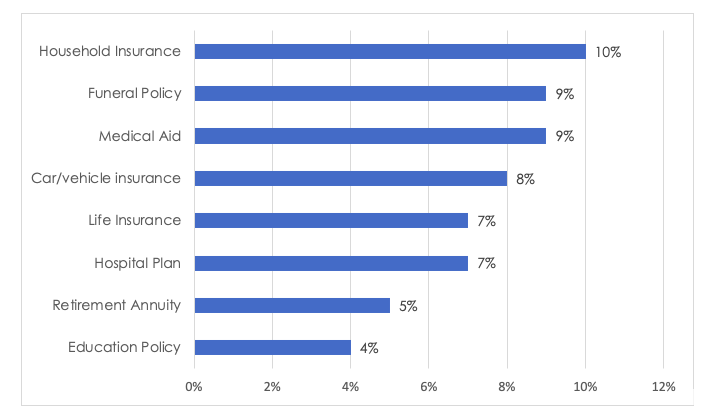

South Africans are looking at ways of cutting the costs across all different expense categories. Precautionary savings, ie financial policies and contracts, are no exception.

But do the savings outweigh the risks of not being ‘covered’? To get an idea of those categories that have been most impacted, TrendER/infoQuest, a South African online research company, asked consumers which policies/contracts they have cancelled over the past six months.

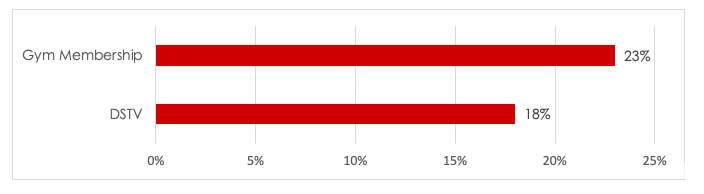

Two subscriptions were also included – entertainment/leisure (gym membership and DStv). The research was conducted during May 2023 and 300 nationally represented consumers were interviewed.

Household contents insurance is the biggest loser with 10% of respondents claiming that they cancelled this insurance over the past 6 months. This is followed by funeral policies (9%) and medical aid (9%). Younger consumers (aged 18–35 years) were more likely to cancel household insurance and medical aid, while the 25–34 age group were more likely to cancel funeral policies.

In terms of the ‘entertainment/leisure’ categories, almost 1 in 4 respondents had cancelled their gym membership over the last 6 months, while DSTV was also a casualty at 18%. Interestingly, there were no significant differences in cancellation rates across the income categories.

‘Unfortunately, the tough economic conditions are resulting in some consumers cancelling their precautionary savings products such as insurance, medical aid and funeral policies,” says Claire Heckrath, TrendER/infoQuest.

“While it may be tempting to cancel personal insurance policies to save money, it is important to recognise the potential risks and consequences. It is crucial to carefully evaluate the potential risks, consult with professionals and make informed decisions based on individual circumstances.”