Advertising spend on a global basis is projected to grow 4.4% this year and 8.2% next year to hit $1 trillion in total spend in 2024, according to a new study from WARC. That’s a lot of money.

Given the dynamism around where the ad spend growth is projected to go, what it could mean to each of you depends where you sit in the ad ecosystem. The growth will not be spread around evenly, either by country, media channel or company.

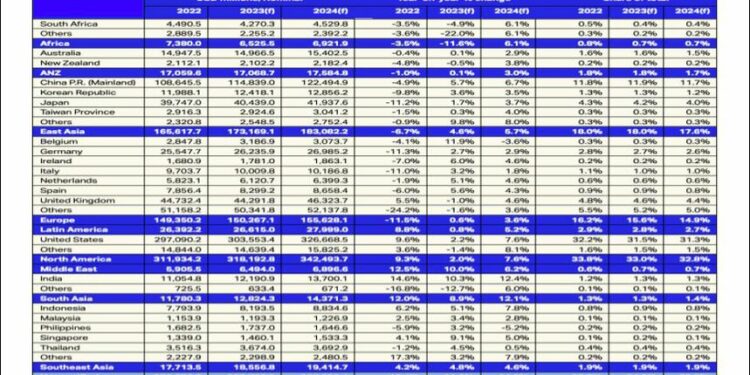

The U.S., China and the U.K. are expected to drive a lot of the growth since even small changes in already big markets mean bigger numbers.

Digital media as a category will grow a lot. In fact, not only will digital capture a growing majority of all ad spend, but five digital companies – Alibaba, Alphabet (Google, YouTube), Amazon, ByteDance (owner of TikTok and Douyin) and Meta (Facebook and Instagram) — will capture 51% of spend by themselves.

So not only will those five companies control a majority of all global ad spend, those five companies are all 100% digital and digital natives. What happened to the notion of years past that the largest traditional media companies would be able to build or buy their way into an equally large digital future?

They all got leap-frogged!

What channels will grow most? Digital ones, of course. Social media, retail media (digital ads powered by purchaser data) and streaming TV are projected to be the fastest growing in capturing spend.

What does this mean for companies supporting the ad ecosystem? A lot.

New technologies, new processes, new suppliers and new talent are needed to support this fast-transforming industry. You can imagine that 10%-40% of that spend will be available to companies that can enable growth for ad buyers, ad sellers, media companies and platforms working in this world.

The areas of concentration are very clear: digital, walled gardens, social, retail, streaming TV. The areas of value creation and disruption are even more numerous: data, identity, privacy, personalisation, measurement, video, gaming, production, modelling – and so on and on.

This is the time to start building strategies, your objectives, your roadmaps. Are you ready to chase that $1 trillion?

This story was first published by MediaPost.com and is republished with the permission of the author.

Dave Morgan, a lawyer by training, is the CEO and founder of Simulmedia. He previously founded and ran both TACODA, Inc, an online advertising company that pioneered behavioural online marketing and was acquired by AOL in 2007 for $275 million, and Real Media, Inc, one of the world’s first ad serving and online ad network companies and a predecessor to 24/7 Real Media (TFSM), which was later sold to WPP for $649 million. Follow him on Twitter @