The stability of any medium is inextricably linked to how consumers maximise a return on their investment – i.e. attention. So to understand how the TV industry is evolving it’s useful to look at what needs are met with the least amount of friction by which platforms.

Speculating about the future of an industry disrupted by technology is a regular pastime for some. Few get it right but I’m getting increasingly comfortable with how the main trends might pan out. I’m known for being a proponent of the robustness of the television model, and by and large I still hold that true. Except that for the first time I can see a breaking point in the far distance.

I am of course referring to the South African market, which has its own dynamics that don’t resemble the United States, Asia or Europe, or for that matter, much of the rest of Africa. But reviewing a single market in isolation is seldom insightful, so I refer here to the macro environment.

Fundamentals of the media ecosystem

TV was so powerful and held out for so long because it fulfilled all five of our primary media needs:

- Information

- Education

- Live sport

- Entertainment, and

- Escapism

As humans, we dedicate a mix of our attention to these needs in accordance with our personal tastes. But attention is a zero sum game – there is a finite amount of it and media platforms have always competed based on their inherent strengths. The key role of technology in media has always been to reduce friction. It was back in Gutenberg’s day in 1440 and is equally true today.

The stability of any medium is inextricably linked to how consumers maximise a return on their investment – i.e. attention. Print media’s business model was upended by the internet’s disintermediation of its distribution platform, the printing press. The internet is a dramatically more efficient, near frictionless distribution model. True for publishing and radio, but not nearly so for TV. Streaming requires considerable bandwidth, which, in South Africa at least, is still quite high up (cost wise) on the exponential decay curve. So TV has largely dominated the latter three needs, even in developed markets where the bandwidth barrier has diminished markedly.

Live sport is the core around which most networks bundled offerings. A prime example is DStv, with SuperSport the golden goose that wears the crown. Appeals to unbundle it are entirely commercially unfeasible. Great content has two defining characteristics: firstly it drives affiliate fees (what’s passed back to the production chain) and secondly, production has a very high entry barrier. Bundling allows networks to aggregate, increasing channel variety while reducing costs. It’s a win-win model for the network and consumer. Production is not only expensive, it also requires bucket loads of talent and skill, where demand outstrips supply.

What’s expensive? ESPN will invest circa $7.3 billion on content this year, and it distributed about $8/subscriber in affiliate fees in 2016. Netflix follows at $6 billion, NBC at $4.3 billion, CBS at $4 billion and Amazon (which has overtaken HBO) with $3.2 billion earmarked for 2017. Across the Atlantic, Sky will invest $7.25 billion. That’s the scale it takes to play in this space, and one that just won’t be disintermediated quickly. ESPN focuses on sport; Netflix, Amazon and HBO

on entertainment, while Sky and the others are a mix.

Networks are the venture capitalists of TV/video – although the odds on a safe return on sport are significantly more predictable than on a TV series – which is precisely why networks trial big entertainment investments. The last series of ER, the long running medical-slash-love-slash-sex drama, cost $13 million per episode, while the last season of Friends and season six of Game of Thrones climbed to $10 million per episode. You get the picture.

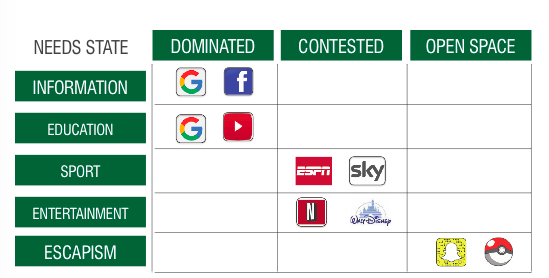

Fulfilled needs state + friction-free distribution = victors

To understand how this industry is evolving it’s useful to look at what needs are met with the least amount of friction by which platforms. Netflix and Amazon are essentially networks, despite not owning broadcast licenses or infrastructure. They meet the same market need as other networks, entertainment. Let’s break this down in terms of needs state and dominant providers:

- Information: Google and Facebook

- Education: Google and YouTube (Alphabet)

- Sport: ESPN, Sky, DStv (no dominant global players, this sector remains geographically fragmented)

- Entertainment: Netflix, Amazon, HBO competing fiercely for the land grab, but traditional networks still hold the high ground

- Escapism: Gaming, Snapchat, and a myriad of apps compete with special interest network channels (think Idols).

- In the near future, AR and VR will be giant killers.

What is clear is that Facebook and Alphabet have colonised information and education, although the latter will evolve into one of the biggest businesses to emerge from the low-friction internet model. Between artificial intelligence (AI) and e-learning, existing education models will be dismantled more rapidly than the publishing industry was. The only question is whether or not this also becomes a winner takes all marketplace.

Sport is so culturally and geographically germane it’s near impossible to see how it could be consolidated into a two or three horse race. It might be unbundled, but will always command a premium from subscribers and advertisers. Similarly entertainment: many western-centric commentators conveniently ignore that Breaking Bad isn’t a universal winner. A single Bollywood production can pull more audiences than an entire Hollywood series – audiences that are becoming rapidly more economically powerful. Hollywood isn’t the epicentre of global entertainment; Disney isn’t the global entertainment benchmark. It never will be.

The last need state, escapism, is up for grabs. Networks don’t stand a chance, thus removing another pillar of their old architecture. The future of networks is about being a specialist in either sport or entertainment, or a bundled combination simply because the economics work that way. In sport and live events, live video and augmented reality (AR) are fringe players for now; the jury’s out on how much traction these models can get and if they can be successfully monetised.

Video (online) vs. television

I maintain the distinction between video and TV is becoming less and less important. A two-tier market is emerging: one mobile, short-form video, driven by social media and e-commerce, the other longer-form on-demand content on bigger screens for a richer, more immersive experience. The delivery platform is increasingly unimportant and interchangeable. In a multi-screen environment, certain content is better suited to certain screens.

The key challenge to media owners is to reduce friction. Don’t put technology at the front end, focus on your content and hide the technology out of the way. Different models will find traction in different markets. In sub-Saharan Africa for instance, forget about high bandwidth streaming (save for the niche one percent). Here, IP models like Tuluntulu, an OTT that free-streams highly compressed TV and radio over GSM networks, are breaking new ground in media distribution previously governed by licenses and territories, opening whole new worlds to hundreds of millions of people and beyond the overreach of governments.

So where do marketers and agencies sit in all of this turmoil? In South Africa, very few are remotely ready or future proof. Agencies are still getting to grips with the analogue/digital dynamic, with two distinct clusters wrangling over control. The holding companies continue to underline this distinction to their detriment. With audiences shifting fluidly in a three-dimensional world, it’s a tough job finding them, let alone measuring ROI.

In the pursuit of growth they’ve lost sight of why they exist in the first place – to bring fresh ideas to the table. Agencies need to be hiring big picture thinkers – computer science graduates, innovation officers and strategic media brains – who have their finger on the pulse of how business models are hypermorphing, where the thousand-year-old underlying principles are being destroyed in decades. Unleash these skills onto a good creative department and the results will flow. Clients don’t have the skills, the time, the resources. Management consultancies are filling the gaps, but they have zero creative skills. There’s just no cultural overlap that can accommodate and unleash creative potential in these corporate environments.

Agencies and marketers shouldn’t be chasing the media model – worrying about where they can find audiences – they should be skilling for innovation so that audiences come to them. They need to lead, not follow. Every business on the planet is facing massive scale existential threats, the opportunities are screaming out for those paying attention to the future, not looking back over their shoulders.

Justin McCarthy (@justininza) is a wildling at large whose favourite subjects are politics, advertising, media, ICT, rugby, wine and offending nanny state advocates.

This story was first published in the March 2017 issue of The Media. To read the digizine, click on the cover.