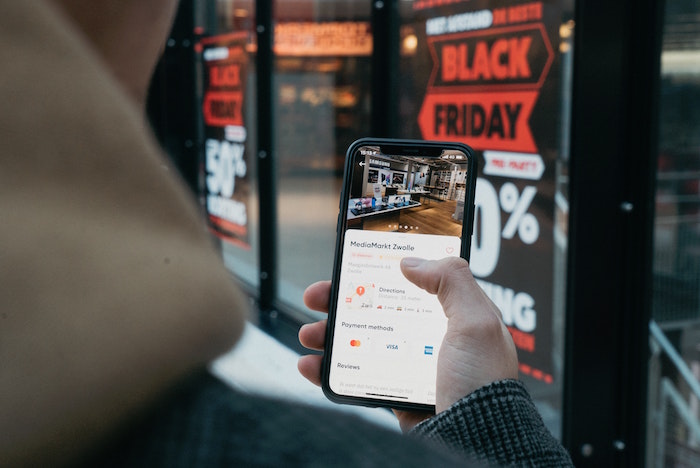

Black Friday – arguably the biggest and busiest retail shopping day of the year – is fast approaching, and there is no doubt that the shopping extravaganza will see shoppers eagerly waiting to grab the best deals of the day.

But while retail stores benefit greatly during Black Friday, and offers become increasingly attractive to reel customers in for the day, can customers get the deals they are looking for and shop smartly to avoid overspending?

Head of finance at FASTA, Daniel Lipchin, shares his advice on how customers can protect their pockets when the 25th of November rolls around for Black Friday.

Online shopping is on the rise in South Africa; what are some top tips to keep in mind when online shopping this Black Friday?

I think it’s important to plan ahead. There may be something you have had your eye on for a while that may be on special during Black Friday; this is a good opportunity to buy that product at a discounted price.

Consumers should avoid impulse buying and falling for ‘bargains’. As the saying goes, too many bargains can make you bankrupt, and while something may be discounted, it still costs more than not buying anything at all – especially if you don’t actually need it! The economy is very tight at the moment with soaring prices due to inflation. Nothing is more valuable than cash flow at this moment in time.

What’s your advice when shopping on a social media-based store or platform like Facebook Marketplace during Black Friday?

Reputation and ratings are everything on these platforms. These platforms are only partially regulated and it’s easy to fall for a scam. Reach out to the sellers, have a conversation with them, ask them for references (even though there could be collusion here), read their customer reviews and perhaps reach out to these reviewees as well. Performing due diligence on your purchase will save you in the end.

Avoid deals that look too good to be true and never pay the full price before getting the goods. Agree to a small deposit – such as 10% – and always meet these sellers in a public location where there is a decent amount of foot traffic.

You mentioned that a deal can be “too good to be true” around Black Friday. If that’s the case, what should consumers look out for?

Consumers should look out for things such as extremely cheap goods that are far below what the market would sell them. It’s also using some common sense – if a deal looks too good to be true, it most likely is. The point of Black Friday isn’t for businesses to lose money.

Buying with cash or credit: which is best to use this Black Friday?

This will vary from person to person but credit should only ever be used when you don’t have the necessary cash available. If you have the cash, use your cash. This will be a cheaper purchase for you. If you don’t have the cash, consider credit alternatives that make financial sense, and do your utmost not to waste the costs of credit on unnecessary purchases.

And finally, are there any ways that customers can truly save on deals and discounts this Black Friday?

The only way a customer can TRULY save on Black Friday is if they are going to purchase the goods regardless of Black Friday. Spending money on products that you wouldn’t have spent on it, had it not been for Black Friday, will cost you more than not spending at all. It sounds obvious but it can be very tempting to fall for a good deal that you may not need.

Daniel Lipchin, Head of Finance at FASTA, is a Chartered Accountant with 7 years of experience within the financial services and wider industry arena. Pro disruption and progression within the Global tech space. South African patriot. Energetic with a passion for success. Empowering teams through collaboration, mutual respect and tolerance.