-

Two in three South Africans plan to travel over the holiday period, mostly within the country.

-

The majority have been saving throughout the year to cover holiday expenses.

-

42% expect to spend more this year on festive activities than last year.

-

Takealot emerges as the most preferred source for gifts.

As another relentless year in a bruising economy winds down, South Africans are more than ready to switch off, slow down, and seek refuge in the festive cheer. The determination to celebrate remains strong. Whether their plans involve hitting the road for a family getaway or embracing much-needed downtime in their local area, there is an effort to prioritise joy and connection regardless of financial pressures.

infoQuest, a trusted South African leader in online research, asked 300 South Africans across all demographics about their holiday plans and gift buying intentions. The results of this research paint a vivid picture of how the nation is celebrating this season.

Dominance of domestic travel

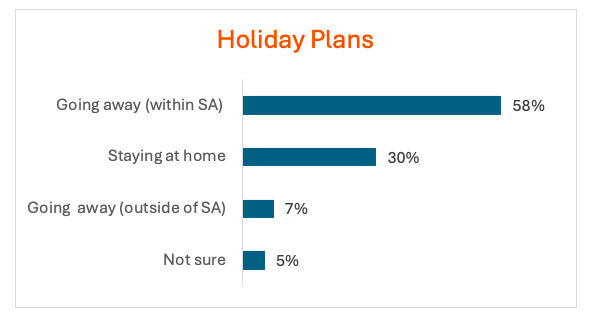

Almost 60% of South Africans are planning to take a break within South Africa during the upcoming holiday season, with about one in three opting to stay at home. Only about 7% will be holidaying out of the country.

Holiday saving vs debt reliance

Three-quarters (76%) of South Africans say they have planned ahead, setting money aside and diligently saved throughout the year for festive spending.

Yet, despite this preparation, a significant portion will turn to debt to get through the season. Credit cards are the preferred way to finance holiday expenses, and the 18–34 age group is especially likely to rely on this form of credit.

| 2025 | |

| Have saved up for holiday expenses | 76% |

| Will use my credit card | 18% |

| With my bonus/13th cheque | 1% |

| Will borrow from friends/family | 5% |

| Will take out a personal loan | 5% |

| Will borrow from my stokvel | 3% |

| I have not made any special provision to cover holiday expenses | 15% |

South Africans reward themselves despite tough economy

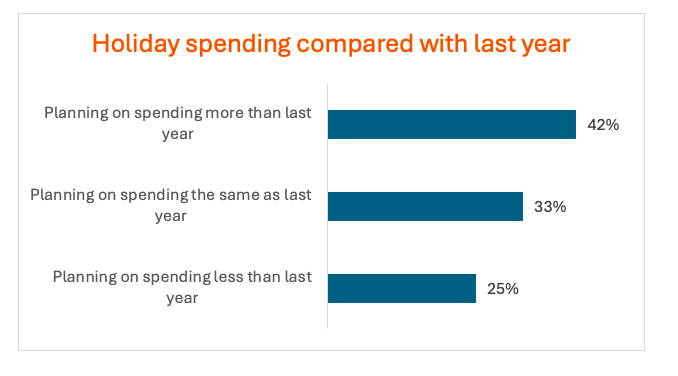

Planned holiday spending compared to last year reveals a surprisingly optimistic consumer outlook, especially when considered against South Africa’s generally slow and challenging economic environment. The largest segment of South Africans (42%) are planning to spend more this holiday season compared to the previous year.

This indicates that, even under financial strain, consumers are placing high value on the end-of-year break. It seems South Africans are keen to reward themselves after a challenging year and have taken steps to prepare by saving for the festive season throughout the year.

The road reigns

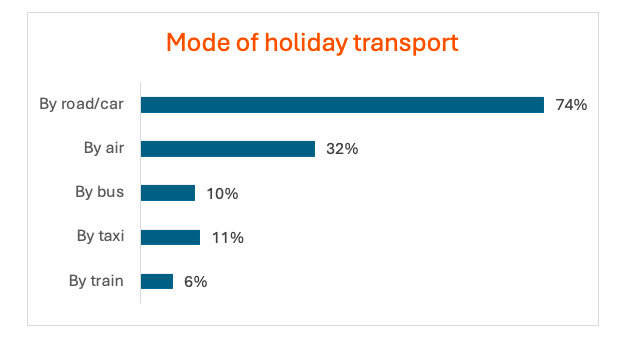

Road transport is by far the most common mode of transport over the holiday period. This overwhelming reliance on private vehicles means that safety becomes paramount. This time of year demands heightened awareness from both travellers and authorities to manage congestion, prevent fatigue, and enforce traffic laws, ensuring that holiday cheer is not overshadowed by road incidents on South Africa’s busy routes.

The family hub: Staying with friends and family dominates festive accommodation

When it comes to holiday accommodation, South Africans are mixing it up. Staying with family and friends tops the list, followed closely by staying in B&Bs and guesthouses. On average, holidaymakers opt for about two different types of accommodation during their travels, adding variety to their getaways.

For those in higher income brackets, hotels and game lodges are more likely to be the preferred choice, offering a touch of luxury. Meanwhile, camping appeals more to men than women, with many embracing the call of the wild and the simplicity of life under the stars.

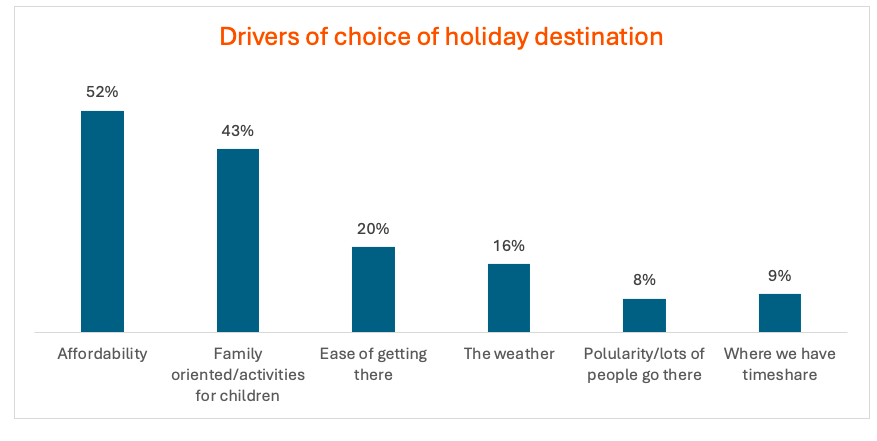

Budget and family experience: The dual drivers of destination choice

The main driver of holiday accommodation choice is, understandably, affordability. This is followed by the preference for family-oriented destinations that cater for children. Together, this strong dual focus on budget and family experience reinforces the trend towards domestic travel, as South Africans seek cost-effective local options that meet the needs of the whole family.

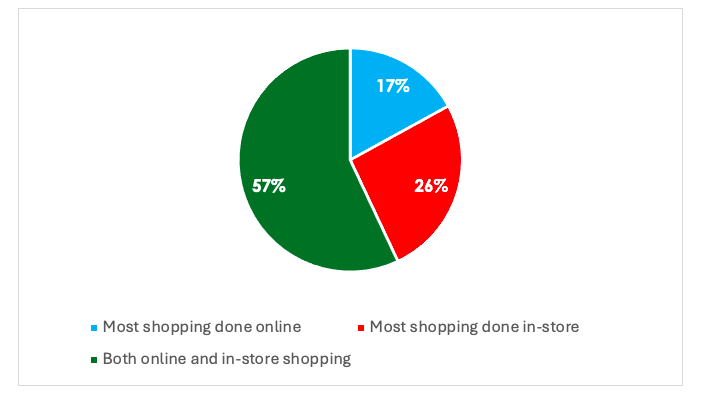

A dual approach to festive shopping

South African holiday shopping is characterised by a dynamic mix of digital convenience and in-store experience. While consumers value the ease of buying online, the festive season draws them back into malls and markets. The surge in in-store shopping is likely fuelled by the irresistible pull of festive décor, lively crowds and the unmistakable buzz that turns holiday shopping into an experience rather than a transaction.

Holiday season gifting: Takealot leads as Clicks and Checkers show strength

Takealot is the overwhelmingly dominant choice, confirming that e-commerce is the undisputed leader for gifting convenience and selection. Notably, the strong performance of Clicks (42%) and Dischem (30%) shows how health, beauty, and wellness products have firmly positioned these retailers as key, high-frequency stops in the gift-buying journey. Checkers also stands out, outperforming direct competitors such as Pick n Pay, Shoprite and Woolworths. Meanwhile Shein and Temu continue to gain traction as popular online shopping destinations.

| Takealot | 61% |

| Clicks | 42% |

| Checkers | 37% |

| Game | 33% |

| Woolworths | 31% |

| Dischem | 30% |

| Shein | 29% |

| Mr Price | 28% |

| Makro | 28% |

| Pick ‘n Pay | 23% |

| Shoprite | 20% |

| Temu | 19% |

| Pep | 18% |

| China Mall/Chinese shops | 16% |

| iStore | 14% |

| Hi-Fi Corporation | 11% |

| Builders Warehouse | 11% |

| Spar | 10% |

| Exclusive Books | 9% |

In essence, the data reveals resilient and determined South Africans prioritising the festive season as a time for self-reward and familial connection, despite the challenging economy. This is demonstrated by the optimistic spending outlook, where a significant portion of consumers plan to spend more than last year.

Beware ‘Januworry’

Domestic holidays are the overwhelming choice, driven by affordability and family-oriented destinations, necessitating a massive volume of road travel (by car) and emphasising the need for road safety.

It is critical to sound a note of caution regarding this festive optimism: relying on credit cards (a preference illustrated, particularly among the 18–34 cohort), or giving in to the temptation to overspend on gifts, is a serious financial risk.

While the holidays offer a much-needed emotional release, accumulating excessive debt now can lead to a punishing ‘Januworry’ effect, where consumers are forced to take new loans to cover essential New Year expenses like school fees and annual insurance increases.

To ensure the hard-earned break is not instantly undone, managing festive spending and avoiding a significant debt hangover is paramount to starting the new year on a sound financial footing.

Claire Heckrath is managing director of infoQuest Africa.