South Africans are grappling with persistent financial strain, a situation exacerbated by a slow-growing economy that has struggled to fully rebound from the impacts of the Covid-19 pandemic.

The initial post-pandemic period saw consumers attempting to regain their financial footing, but two years later, the situation has not improved in any substantial way for much of the population.

Lingering economic challenges, including high unemployment, lower-than-inflation salary increases and a weaker rand mean that household incomes are often stagnant while the cost of living continues to climb.

This creates a challenging environment where families are forced to make tough choices simply to cover essential expenses.

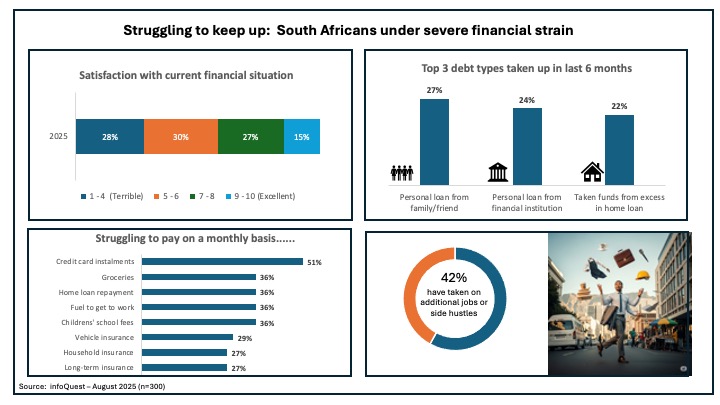

In August 2025, infoQuest, a leading South African online research company, conducted a survey in conjunction with CX consultancy, Decapod Customer Experience, to assess South Africans’ current financial situation, and what they are doing to cope with financial pressures.

This article explores the findings of this survey, in which 300 consumers were interviewed across demographics.

Low satisfaction levels with financial situation

Overall, South Africans are dissatisfied with their current financial situations, with only 15% being very satisfied.

The mean score out of 10 in 2025 was 5.8 compared with 5.4 in 2023, indicating a marginal improvement, although not significant. 2023 was the immediate post-Covid-19 period when consumers were trying to gain their financial footing again after disruptions to their lives and finances.

The 2025 results show that the current situation for most South Africans has not improved in any substantial way, even after a further two-year period.

Some financial stress alleviation, due to concerted efforts by consumers

Despite low satisfaction with their financial situations, about two in five consumers claim that their current financial situation is better than it was a year ago (although this is significantly lower in the 50+ age category, where financial pressure seems to be more pronounced than in younger age categories).

Any improvements or better management of financial situations seem to be driven by deliberate, concerted efforts and actions taken by consumers to better manage their finances, rather than any real improvement in their overall financial status.

Claire Heckrath is managing director of infoQuest. She is an experienced managing director with a demonstrated history of working in the market research industry.