The Agency Scope 2021/2022 report, compiled by research company Scopen in conjunction with the Independent Agency Search & Selection Company, reckons South Africa’s creative agencies are encroaching on media agency spaces.

The largest sample for Agency Scope in South Africa to date – 465 video interviews comprising 239 leading marketing professionals from 158 companies; 156 creative agency professionals; 50 media agency professionals; and 20 media owners – has resulted in a an intriguing roadmap for all stakeholders.

Highlighting just the key points from any of the SCOPEN studies is never easy but it is important to spotlight certain trends that arose during the pandemic and will likely grow as economies recover.

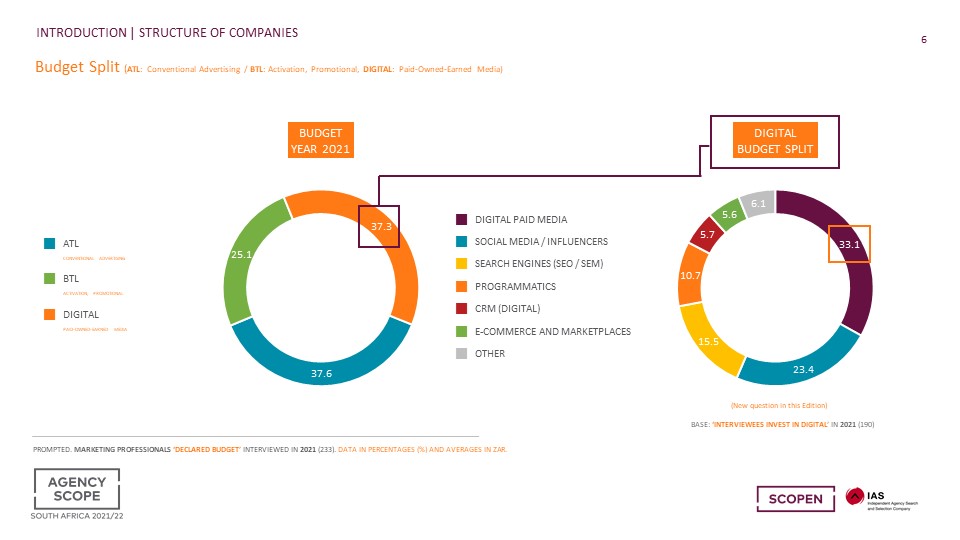

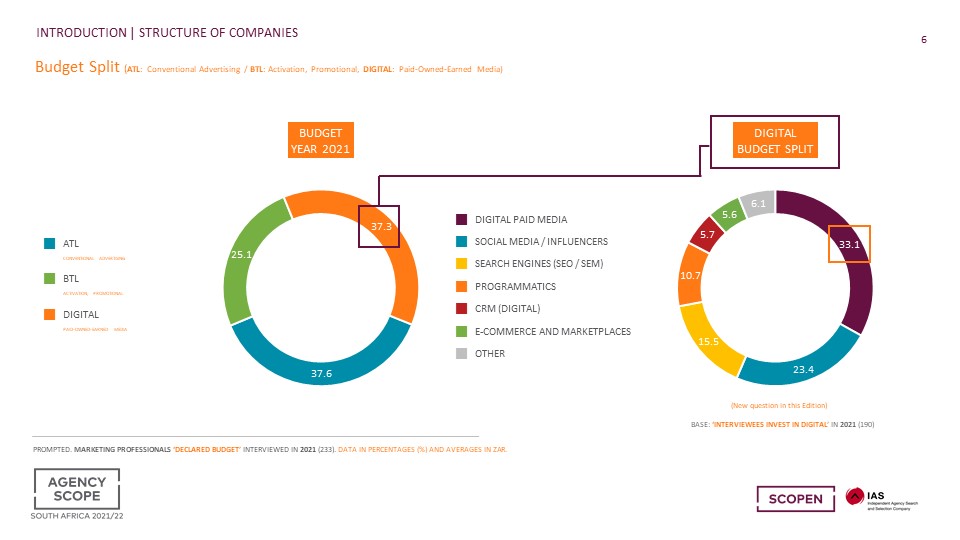

We agree that digital is on everyone’s lips and certainly on top brands and agencies’ agendas. Digital has grown 2.9 percentage points (+7.6%) in the last three years, with China and Brazil designating a budget of 50.1% and 45.1% respectively. The IAB South African Digital Ad Spend Report for 2020 showed the digital industry experienced an 18% year-on-year growth, despite the economy.

Agency Scope 2021/22 reveals current digital ad spend accounts for 38% of marketing spend in South Africa; with overall digital spend divided largely between three sectors: digital paid media (33.1%), social media and influencers (23.4%), and search engine optimisation (15.5%).

Global investment in the sector continues apace, with the data showing that in this more complex ecosystem, each advertiser surveyed works with an average of 13 different partners across communications, marketing, advertising and media projects.

Managing this number of partners requires robust leadership to establish which companies are responsible for which space, and how to keep them in their own lanes. A standout in the research is the satisfaction clients expressed with their agencies, and appreciation of the lengths agencies went to in intensifying working relationships through the pandemic.

Clients are acutely aware of and grateful for the strength of their partnerships with their agencies.

Investment and integration

Agency Scope 2021/22 analysis also highlights how marketers invested their spend. Globally, investment is about 50% on brand building, long-term brand development and big campaigns; and around 50% in shorter-term, performance and sales driven lead generation initiatives.

What this tells us is that reinforcing brands in the minds of the consumer is of equal importance to marketers as the short-term wins from leads and sales. The take away from this part of the research is that opportunity for big branding campaigns should not be ignored.

With regard to the marketers’ more intricate ecosystem, an integrated agency is what most seek. When asked which disciplines comprise their definition of an integrated agency, almost 100% said ‘digital and advertising’, which is largely in line with previous figures. However, the percentages for PR, media, activation and events decrease in number of mentions, but the rest of the disciplines remain stable from 2019.

To determine the model of integration companies are employing, business leaders were asked whether they have a lead agency coordinating their communications requirements. Seven out of 10 in South Africa identified a lead agency to address this need, noting that large and medium-sized companies declare the highest percentage, being 75.4% and 70.4% respectively.

The expanding role of the media agency

While the nuts and bolts of the media agency’s role aren’t changing, it is growing. Making sure the channels and media opportunities they recommend to their clients are the most appropriate and best performing, and dispensing budgets accordingly, is still core to their function.

A look at Agency Scope 2021/22 data will show the media agency has become a far more valuable marketing partner than ever before. Where media agencies shine is in their ability to examine all possible channel opportunities.

In their infancy, digital platform owners often bypassed media agencies and worked directly with marketers – and some still do, possibly to their detriment.

Agency Scope shows 57% of clients prefer their media agency to look after their digital initiatives along with their current responsibilities, to ensure they’re getting the best deals, and the channels’ performance is up to scratch.

To make prime recommendations, media agencies have had to become far more agile to ensure the pace at which they make choices matches the rapid growth of choices being offered.

Bearing this out, Agency Scope shows that South African CMOs believe media agencies contribute an average of 34.1% to a client’s growth, where the global average is 24.2%. With years of experience across all sectors of media and marketing, we are adamant about one thing: In the complexity of media channels and the ever-increasing platforms arising today, I would not make a single decision without consulting a media agency expert. They are matchless when it comes to making sure a target audience is reached.

It’s always in the numbers. Media agencies can quantify their choices to clients, and the number of CMOs in Agency Scope 2021/22 who agree highlights this.

With the complexity and fragmentation of media channels coupled with new ones coming on stream, SCOPEN spotlights the marketer’s core role as being one of total immersion in the brand, so trusting their media agency to make choices in the brand’s best interests is vital.

Johanna McDowell is CEO of the Independent Agency Search & Selection Company (IAS) and SCOPEN partner, and Cesar Vacchiano is president and CEO of SCOPEN International.