The decision on the penalty phase of the Google antitrust trial about its search business is out, and Google won big.

There is no breakup of Google’s businesses, not even into separate subsidiaries. There is no requirement to spin out the Chrome browser. There is no requirement to spin out the Android operating system. There isn’t even any requirement to stop paying Apple to be the default search on its iPhones.

OK, Google can’t do “exclusive” search deals on mobile platforms in the future. But just watch how this plays out, since users will probably have to dig deep into their settings to find ways to change their default search providers.

The decision was a big win for Google and a big lesson to all the folks pontificating on the sidelines about how certain they were that the court would impose huge structural penalties that might require massive, constant and technical oversight.

Search ad monopoly

No U.S. district court judge wants to be a present-day version of Judge Harold H. Greene, who famously broke up the AT&T monopoly into ‘Baby Bells’ — and spent the next decades of his career administratively babysitting that crazy constellation of companies and all the inquiries about whether or not they were complying with or evading his landmark ruling.

Actually, the Google search ruling reminds me more of the antitrust ruling the USFL football league secured against the NFL in 1986. The court ruled that the NFL had conspired against the USFL, but only awarded $1 in damages (trebled to $3 as per the antitrust law), since it determined the USFL was harmed more by its own actions than from what the NFL did to it.

Look at what Wall Street did

I would extend that logic here to a degree. Google built an extraordinary search ad monopoly, but it has also been aided by an industry that constantly does so much to hurt itself. How many advertisers and agencies don’t know — and just don’t care — how their spend actually works? How many are just looking for an ‘easy button’? How many prefer deniability to accountability?

This was a big win for Google. For evidence, Look at what Wall Street did. The price of Alphabet stock (Google’s holding company) rose 8% on the day.

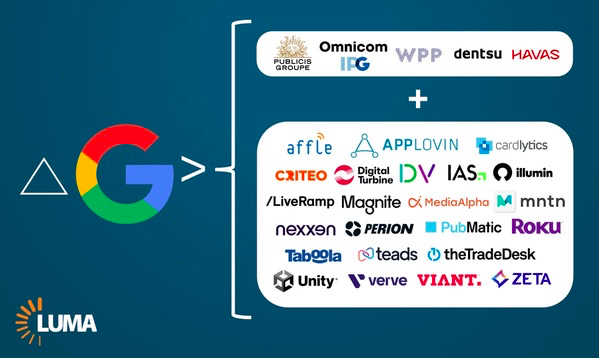

As Luma’s Terry Kawaja so aptly called out yesterday on social media, “Google gained more in market cap today ($230 bn) than the total value of all of the Agency Holding Companies and all of the public Ad Tech sector.”

Wow. In one day, Google gained more enterprise value than the entire ad services and ad-tech industry. And, to be clear, virtually every company on Kawaja’s list is, and has been, massive, loyal enablers of Google and its businesses. So look who won that trade.

This story was first published by MediaPost.com and is republished with the permission of the author.

Dave Morgan, a lawyer by training, is the CEO and founder of Simulmedia. He previously founded and ran both TACODA, Inc, an online advertising company that pioneered behavioural online marketing and was acquired by AOL in 2007 for $275 million, and Real Media, Inc, one of the world’s first ad serving and online ad network companies and a predecessor to 24/7 Real Media (TFSM), which was later sold to WPP for $649 million. Follow him on Twitter @davemorgannyc