Financial fraud in South Africa’s consumer market is posing a growing threat. As the use of digital platforms become more widespread, so do the opportunities for fraudsters to exploit vulnerable consumers.

Socio-economic challenges and differing levels of financial literacy make South Africans prime targets, creating a perfect storm for deceptive schemes to flourish.

In October 2024, infoQuest, a South African online research company, surveyed around 1 000 South Africans from diverse demographics to uncover whether they had fallen victim to financial fraud and how they perceived the response to these incidents from their financial institutions.

Key insights from the research are highlighted below.

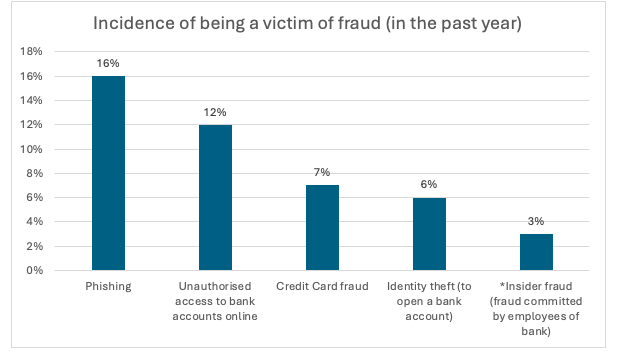

Phishing and unauthorised access to bank accounts online were the main types of fraud that consumers had fallen victim to. Younger consumers (aged 18–24) were more affected by credit card fraud and identity than older consumers.

Overall, I in 3 consumers had been a victim of some type of financial fraud in the past year.

Caution: small sample base

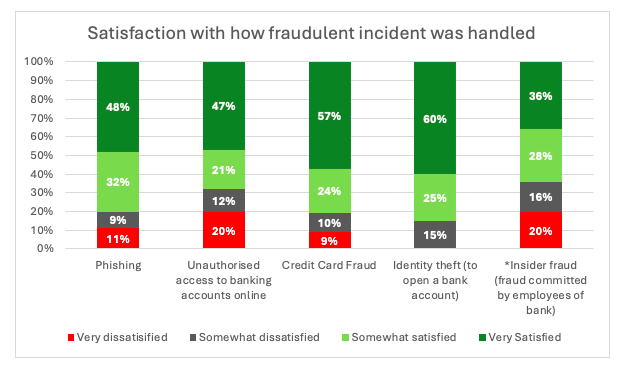

Consumers expressed greater dissatisfaction with how their banks handled unauthorised access to online banking accounts and insider fraud.

Notably, Gauteng residents were significantly more frustrated with their banks’ response to online account breaches compared to other regions.

* Caution: small sample size

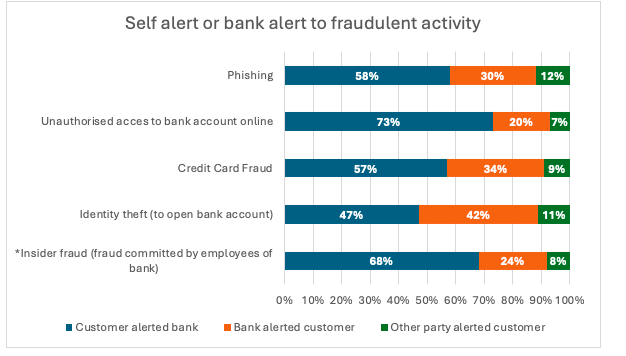

In most cases, it was the consumers who informed the bank about fraudulent activity, rather than the bank notifying them. However, when it came to identity theft for opening bank accounts, banks were more likely to alert consumers compared to other types of fraud.

* Caution – small sample size

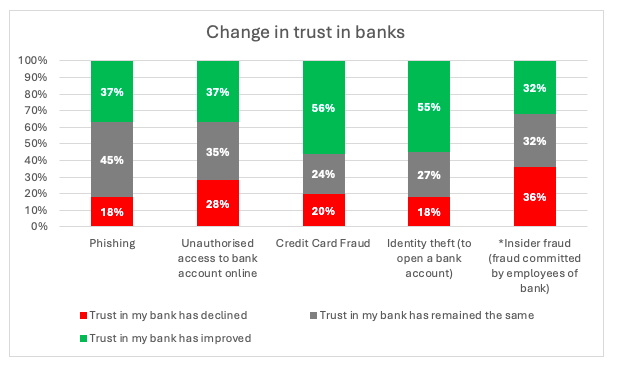

Credit card fraud and identity theft (for opening a bank account) caused the least damage to consumer trust in banks, which correlates with the fact that banks were more proactive in alerting consumers about these issues.

The findings clearly show that trust in banks is significantly influenced by how fraud incidents are handled. Efficient and effective management of these cases is crucial for maintaining consumer satisfaction and loyalty, and banks that fail in this area risk eroding their customer base.

* Caution – small sample size

Consumer financial fraud in South Africa not only results in financial losses for individuals, but also strikes at the core of trust in the banking sector. With scams growing ever more sophisticated, many consumers feel increasingly vulnerable, questioning the safety of their financial interactions.

This growing distrust doesn’t just discourage engagement with banks, but also stifles financial inclusion and undermines the stability of the broader economy.

“To tackle this pervasive threat, banks must adopt a comprehensive strategy,” explains Claire Heckrath, MD of infoQuest. ‘While robust security measures are essential, empowering consumers with education is just as crucial.

“When consumers are equipped to recognise and report fraud, they become the first line of defence. Moreover, fostering open, transparent communication between banks and consumers is key to rebuilding trust, ensuring a secure and more resilient financial system.”

Only through this balanced approach can we hope to stem the tide of financial fraud and restore confidence in South Africa’s banking ecosystem.