Radio, a cornerstone of media consumption for more than a century, is in the midst of a significant transformation.

While traditional terrestrial broadcasts remain embedded in the daily lives of many South Africans, the growing popularity of digital platforms and streaming services is reshaping how audiences discover and engage with audio content.

From April to June 2025, infoQuest, a leading South African online research company, conducted a nationally representative survey among one thousand radio listeners across all demographics to explore these shifting patterns.

As part of this initiative, and In parallel, Media Host Group piloted a passive listening study using its proprietary audio recognition technology, offering an additional layer of real-time behavioural insight. These complementary approaches allow for both stated preferences and observed listening behaviours to be considered.

This joint report explores the intersection of traditional and streaming formats, tracks evolving listener behaviours and preferences, and assesses the effectiveness of radio advertising in today’s hybrid media landscape.

The analysis reveals a hybrid consumption model, with listeners effortlessly shifting between traditional radio and a growing ecosystem of digital devices and platforms. This evolution goes beyond a change in delivery – it signals a fundamental redefinition of the listening experience, one that offers audiences greater choice, control and personalisation.

For broadcasters, advertisers, and content creators, understanding these shifting patterns – ranging from preferred content genres to optimal ad timing and format – is key to staying relevant and resonant. As these trends unfold, a compelling narrative emerges: radio streaming is no longer a secondary channel, but a rising force that could shape the next chapter of audio media consumption.

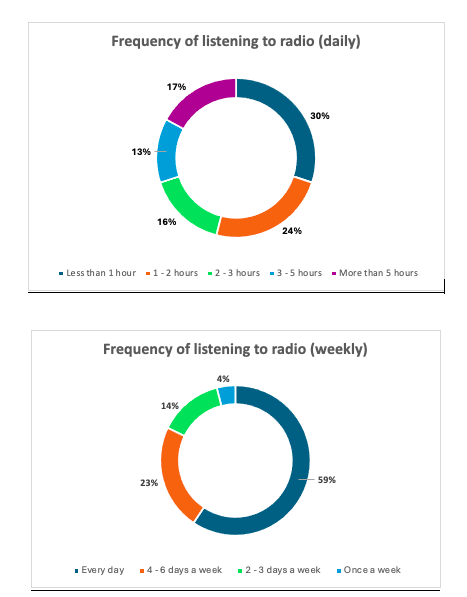

Frequency of radio listenership

Just over half of the targeted sample listen to the radio for two hours or less on a daily basis, with very dedicated radio listeners accounting for about one in five listeners (those that listen for 5 hours or more every day). The majority listen to radio on at least six days a week, indicating the popularity of radio in media consumption.

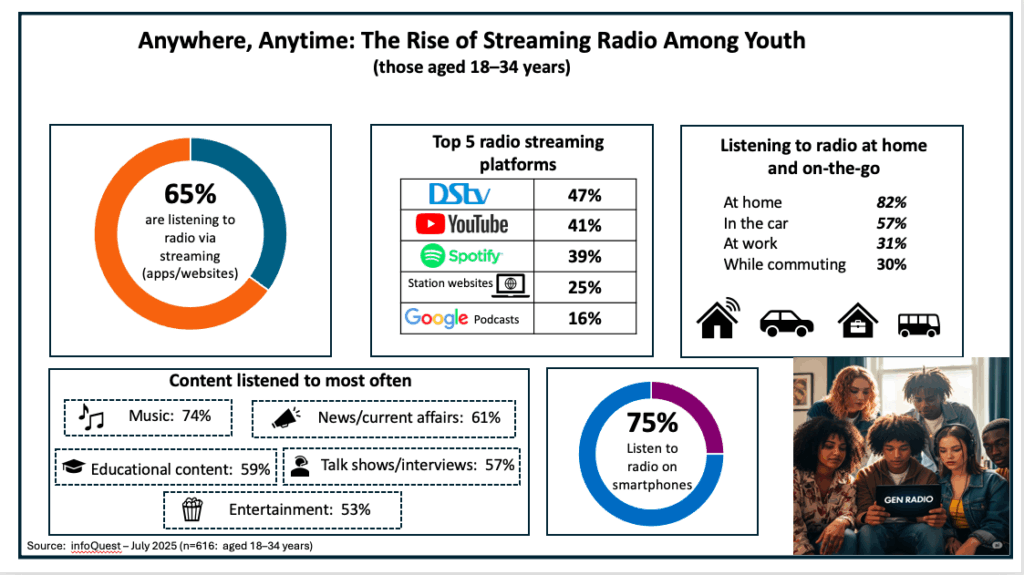

The popularity of streaming radio services

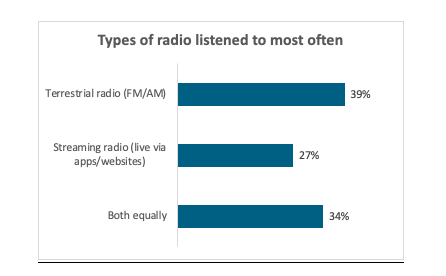

While traditional terrestrial radio remains the most frequently listened to type, streaming radio has established a significant and growing presence. The fact that 34% of respondents listen to both equally, combined with the 27% who primarily use streaming, indicates that a large segment of the audience (over 60%) is actively engaging with digital radio platforms.

This suggests a trend towards hybrid radio consumption, where listeners are comfortable utilising both traditional and modern methods, and highlights the increasing importance for broadcasters to maintain strong digital offerings to reach their audience.

Demographically, older listeners are more likely to listen to terrestrial radio only, as well as white listeners and Afrikaans listeners.

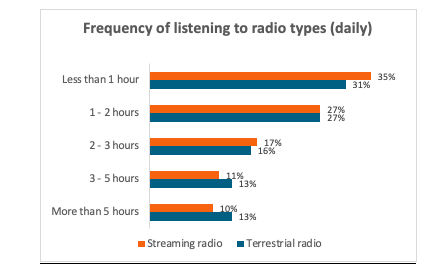

Current listening durations for streaming and terrestrial are currently similar

‘Less than 1 hour’ is the most popular listening duration for both types of radio, though streaming radio slightly edges out terrestrial radio. This suggests a preference for shorter listening sessions across the board. Streaming radio may also appeal more to ‘casual’ listeners who want ‘quick listens’ or are in situations where shorter burst of audio are preferred.

Terrestrial radio tends to retain a slightly higher percentage of long-duration listeners. This may imply that dedicated, long-form listening might still be more associated with traditional radio.

Overall though, there are no significant differences between listening durations for streaming and terrestrial radio currently, but monitoring of any trends is important for future media planning.

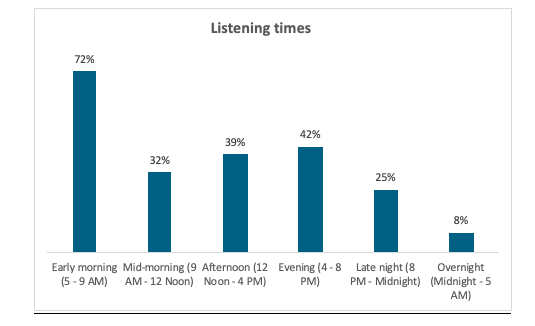

Prime time listening

Early morning (5 AM – 9 AM) is the peak listening time, with 72% of listeners tuning in. This strongly suggests that radio, both traditional and streaming, plays a significant role in people’s routines as they start their day, likely for news, traffic, and morning shows.

Evening (4pm-8pm) is the second most popular listening period – another surge in listenership during the commute home or unwinding after work.

The afternoon slot (12 noon – 4pm) also sees a notable percentage of listeners, suggesting a steady listenership through the workday, possibly during lunch breaks or while performing tasks.

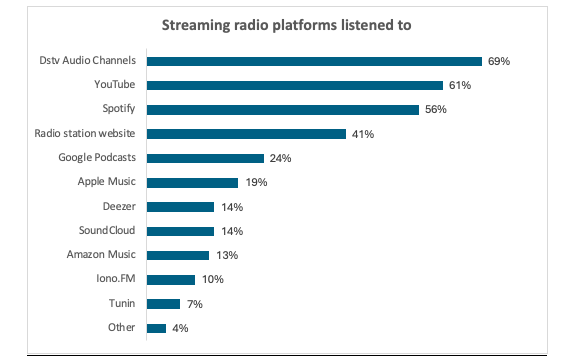

The multi-platform landscape

Dstv Audio Channels is the most popular streaming radio platform, followed by YouTube and Spotify. These platforms are well-established for audio and video content, indicating their strong presence in the streaming radio space.

Traditional ‘radio station websites’ still hold a substantial share of listeners using these websites for streaming, indicating that direct engagement with broadcasters’ own platforms remains relevant. Podcast-specific platforms like Google Podcasts have a moderate but notable presence, but may highlight a growing popularity of podcast consumption within the streaming radio ecosystem in future.

Other major music streaming services like Apple Music, Deezer, SoundCloud and Amazon Music have smaller, but still present, listenerships for streaming radio. These platforms, while popular for music, appear to be less dominant specifically for ‘streaming radio’ compared to the top contenders.

On average, a streaming radio listener uses approximately 3 streaming radio platforms. This means that streaming radio listeners are not exclusive to a single platform. Instead, they are actively engaging with and switching between multiple services.

Listeners might be using different platforms for different purposes: for general radio listening, for music, or podcasts, etc. Listeners may be curating their listening experience by leveraging the strengths of various services.

Especially notable for content creators and advertisers, this means listener attention is fragmented across numerous platforms – listeners are layering their listening experiences. They are also taking control of their audio consumption by seeking out the best content or experience across a range of options. This multi-platform usage suggests a competitive market, with platforms needing to innovate and offer value propositions to attract and retain listeners.

Media Host’s pilot study echoed this fragmentation, picking up listening activity across a wide range of platforms. Even within short listening windows, participants often switched between services, reinforcing the idea that today’s audio environment is multi-channel and dynamic.

With a mobile passive listening application, designed to monitor and analyse audio content that individuals are exposed to, offering valuable insights for advertising and audience measurement in the broadcast industry, is key.

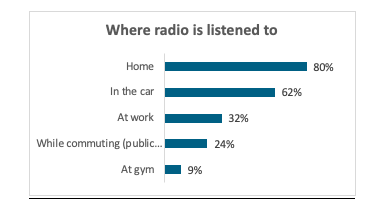

Radio’s reach: From home comfort to on-the-go companionship

Home is overwhelmingly the primary location for radio listening, with 80% of listeners tuning in from the comfort of their living spaces – affirming its role as a trusted companion in daily domestic routines.

Therefore, radio remains a significant part of domestic routines and serves as a companion at home. In-car listening comes in second with 62% listening on the road – underscoring radio’s lasting presence during commutes and travel.

While workplace policies may limit usage, radio still finds its way into the office – nearly one in three people listen while at work, showing that radio continues to thread through multiple aspects of daily life.

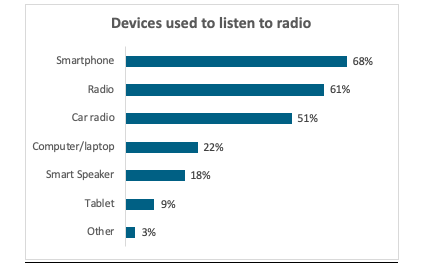

The device revolution: Radio’s multi-device presence

Smartphones are the leading device for listening to radio, highlighting the pervasive role of mobile technology in media consumption and suggests that listeners are increasingly accessing radio content through apps or web browsers on their phones.

Media Host’s passive listening app, operating unobtrusively on mobile devices, captured a broad spread of listening environments – from home and in-car to mobile on-the-go – highlighting the role of smartphones as a central hub for hybrid audio consumption. Despite this new trend, however, there are still dedicated radio listeners.

The data reveals a hybrid listening landscape, where modern digital devices (smartphones, computers, smart speakers) are increasingly popular, but traditional radio sets and car radios still command a significant portion of the audience. This suggests a need for broadcasters to maintain presence across multiple platforms and device types.

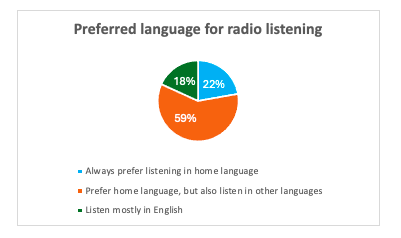

A multilingual and flexible audience

Around 60% of radio listeners prefer content in their home language, yet remain open to broadcasts in other languages. This points to a flexible, multilingual audience – one that values cultural connection but isn’t limited by it, reflecting South Africa’s rich linguistic diversity.

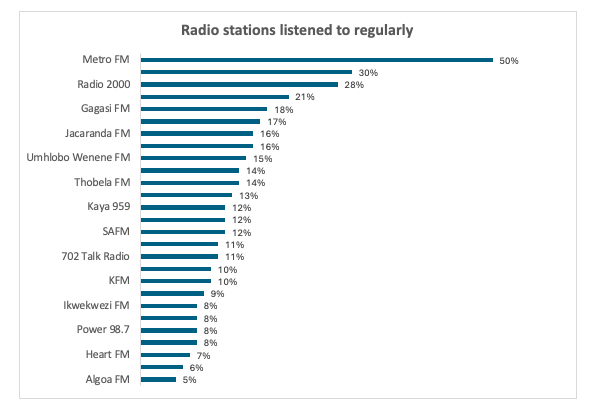

A fragmented station landscape

Metro FM is the leader in regular listenership, with a substantial 50% of respondents tuning in. This indicates a very strong reach and popularity for this station. Radio 2000 and Gagasi FM follow as the next most popular stations, with 30% and 28% respectively.

The market is somewhat fragmented beyond the top few stations. While Metro FM has half the listeners, many other stations capture significant but smaller shares, indicating diverse preferences among the audience.

A mix of national (e.g. SAfm, Radio 2000), regional (eg Jacaranda FM, KFM), and genre-specific (eg 702 Talk Radio, Power 98.7) stations are popular. This suggests that listeners seek out radio for various reasons, from broad entertainment to specific news or music formats.

On average, listeners regularly tune in to four different radio stations, highlighting the fragmented nature of the radio ecosystem. Rather than sticking to a single station, audiences gravitate toward variety – shaped by changing moods, diverse content needs, and the ease of switching between genres and formats throughout the day.

This behaviour reflects a dynamic listening culture where flexibility and personalisation drive engagement.

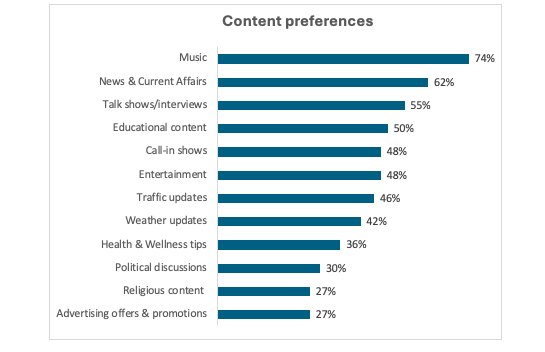

Music leads, but information and interaction thrive

Music is the undisputed leader in content preference, with a significantly higher percentage than any other category, indicating it is a primary driver of engagement.

There is also a steady appetite for informative content – particularly News & Current Affairs and Educational programming, highlighting that a significant segment of the audience turns to radio not just for entertainment, but to stay informed and continuously learn.

Interactive and conversational formats (talk shows/interviews and call-in shows) are also high on the preference list, suggesting audiences enjoy engaging with and listening to discussions.

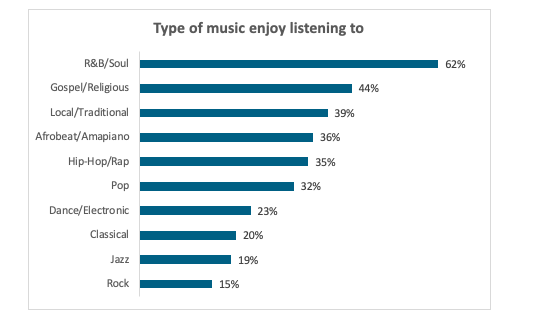

R&B/Soul is the most listened to music genre, followed by gospel/religious, and local/traditional. Overall, the preferences lean towards genres with strong vocal elements and cultural roots (R&B/Soul, Gospel, Local/Traditional, Afrobeat/Amapiano, Hip-Hop/Rap, Pop).

Radio advertising’s impact: Driving purchases and consideration

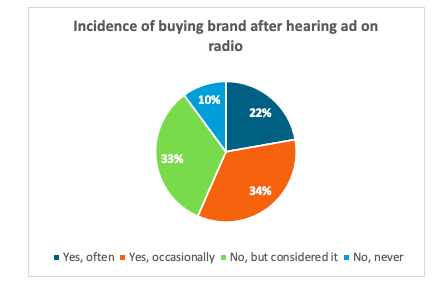

Radio ads frequently influence purchase decisions: A significant portion of respondents (56% combined) either often (22%) or occasionally (34%) buy a brand after hearing its ad on the radio. This highlights radio’s effectiveness as a direct response advertising medium.

Consideration is also high, even without immediate purchase: An additional 33% of people considered buying a brand after hearing a radio ad, even if they didn’t make the purchase. This indicates that radio advertising is highly successful in generating brand awareness and interest, laying the groundwork for future conversions.

Crafting memorable ads: Offers, humour and jingles lead the way

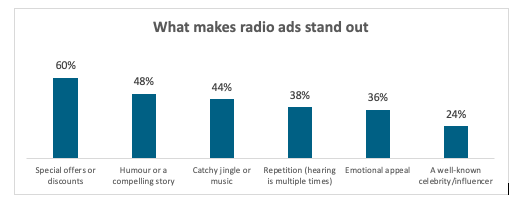

Special offers and discounts are the most effective way to make a radio ad stand out, with 60% of respondents identifying this as a key factor. This suggests that tangible benefits are a primary driver for listener attention and recall. Humour or a compelling story is highly effective, ranking second at 48%.

This indicates that engaging narratives and entertainment value significantly contribute to ad memorability.

Catchy jingles, repetition and emotional appeal also have an influence, while celebrity or influencer endorsement is less impactful.

Seize the Morning: 5.00 am–9.00 am is prime time for ad engagement

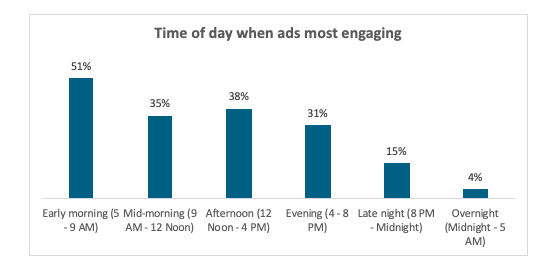

Early morning is the peak time for ad engagement, with 51% of respondents finding ads most engaging between 5.00 m and 9.00am.

Interestingly, Media Host’s real-time listening data aligned with these findings, confirming that early morning and afternoon slots saw the highest levels of exposure to ads – particularly on music-heavy and commuter-friendly stations. This suggests that the morning commute or start of the day is a prime window for advertisers.

Afternoon also shows strong engagement, while mid-morning and early evening have moderate engagement levels. All of these time slots offer good opportunities for reaching an engaged audience.

The insights from this analysis point to radio streaming as a formidable and increasingly central player in the media landscape, solidifying its position as a contender for the ‘next media source.’

While traditional radio maintains its loyal base, particularly among older demographics and for longer listening sessions, the data highlights a clear and accelerating trend towards digital consumption. Over 60% of respondents actively engage with streaming platforms, demonstrating a widespread comfort and preference for digital audio.

The average listener’s engagement with approximately four streaming platforms underscores a fragmented yet highly active audience, eager to curate their listening experience across diverse services like DStv Audio Channels, YouTube and Spotify. This multi-platform behaviour signifies a listener-driven ecosystem where convenience, choice, and personalised content are paramount.

Furthermore, the enduring power of radio as an advertising medium is amplified in this streaming era. Radio ads demonstrably influence purchase decisions, with a significant portion of listeners either buying or considering a brand after exposure. The effectiveness of ads is maximised through clear calls to action, such as special offers and discounts, and by leveraging engaging narratives and catchy jingles.

Crucially, the peak engagement times in the early morning and afternoon remain golden opportunities for advertisers, regardless of the delivery mechanism. The strong preference for music, coupled with a consistent demand for news, current affairs and educational content, provides a clear roadmap for content strategies.

An application captures listening habits by discreetly operating in the background on a mobile device, recording audio snippets, and matching them with a database of broadcast content using audio fingerprinting technology. This ensures accurate identification of programmes, songs or advertisements without requiring user intervention, thereby minimising battery usage and device interference.

In conclusion, radio is not fading; it’s evolving. By combining large-scale survey research with emerging passive listening techniques, this report offers a 360-degree view of listener habits – what people say, and what they actually do.

The data suggests that streaming is not merely a parallel channel but the primary growth vector for radio’s future. Its accessibility via smartphones, smart speakers, and computers, coupled with listeners’ willingness to explore multiple platforms, positions streaming radio to capture an ever-larger share of audio consumption.

For the industry, this means a critical imperative to invest in robust digital offerings, innovative content, and targeted advertising strategies that embrace the hybrid, multi-platform nature of the modern radio listener. Radio streaming is not just a trend; it is the natural progression of audio media, poised to lead as the next pervasive media source.

The enduring demand for informative content, particularly News & Current Affairs and Educational programming, unequivocally demonstrates that radio listeners aren’t just seeking entertainment – they’re hungry for knowledge and staying updated.

This powerful insight, previously understood through traditional methods, is now being validated and enriched by a groundbreaking innovation. Our collaboration with Media Host Group, utilising highly technical, passive listening data marks a transformative moment for radio research.

This sophisticated technology provides an unprecedented level of depth and accuracy, moving beyond stated preferences to truly capture authentic listening behaviour. It allows us to definitively demonstrate the strong and consistent demand for informative content, providing irrefutable data that empowers us to shape a more informed future for both broadcasters and their knowledge-seeking audiences.

Claire Heckrath is managing director of infoQuest. She is an experienced managing director with a demonstrated history of working in the market research industry. Skilled in corporate communications, market research, management, competitive intelligence, and business management. Strong business development professional graduated from Holland Park, London.