Rising new business costs are a growing concern for agencies worldwide. In response, SCOPEN conducted a focused study in Brazil, Chile and Spain, analysing industry trends and advertiser practices.

Following its success, the research was extended to South Africa earlier this year, providing fresh insights into the local market.

César Vacchiano, president and CEO of SCOPEN, said, “We kept the questionnaire simple for our first New Business Report in South Africa to encourage agency participation. When we run it again in 2026, we plan to include more in-depth questions for deeper insights.”

The report, based on responses from two holding media groups and 16 media agencies, was finalised in February 2025.

It offers a clear snapshot of the challenges, opportunities and evolving dynamics between advertisers and media agencies, equipping industry leaders with vital data to assist them in navigating an increasingly competitive landscape.

Key findings from the report

New business structures

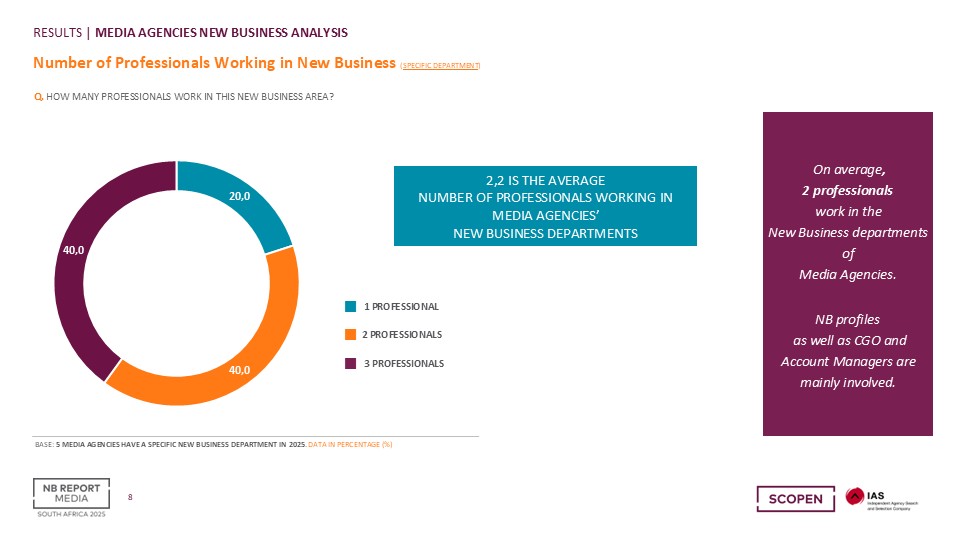

- One in four (27.8%) of South African media agencies have a specific new business (NB) department.

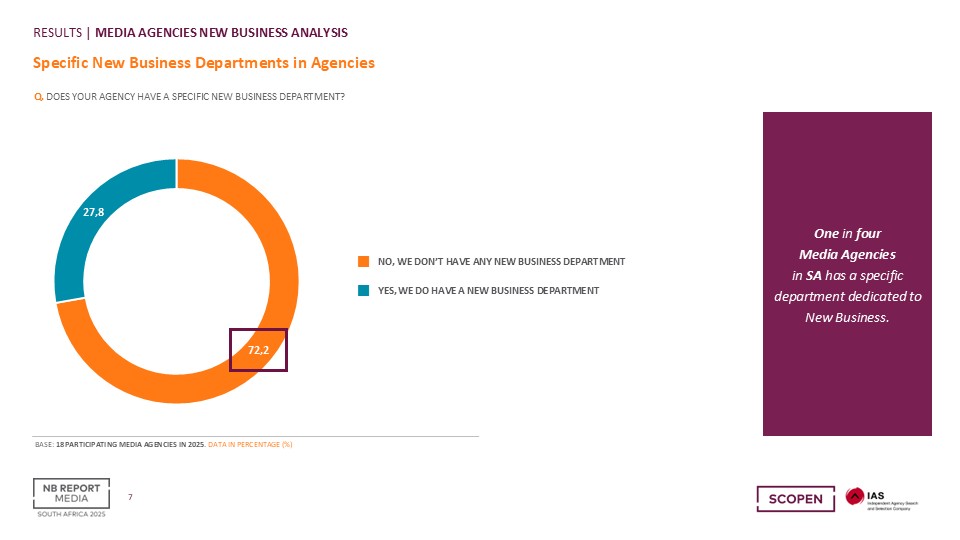

- On average, two professionals work in the NB departments of media agencies.

- New business, chief growth officer and account managers are the key role profiles.

Pitch activity and success rates

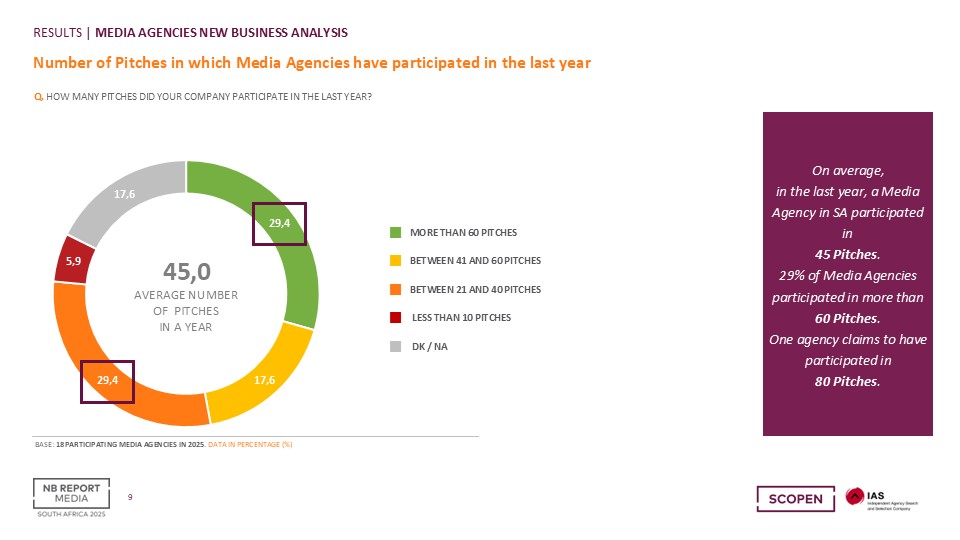

- South African media agencies participated in an average of 45 pitches last year.

- 29% of media agencies participated in more than 60 pitches.

- The average conversion rate was 14%, with more than half of agencies reporting a success rate below 10%.

Transparency in pitching

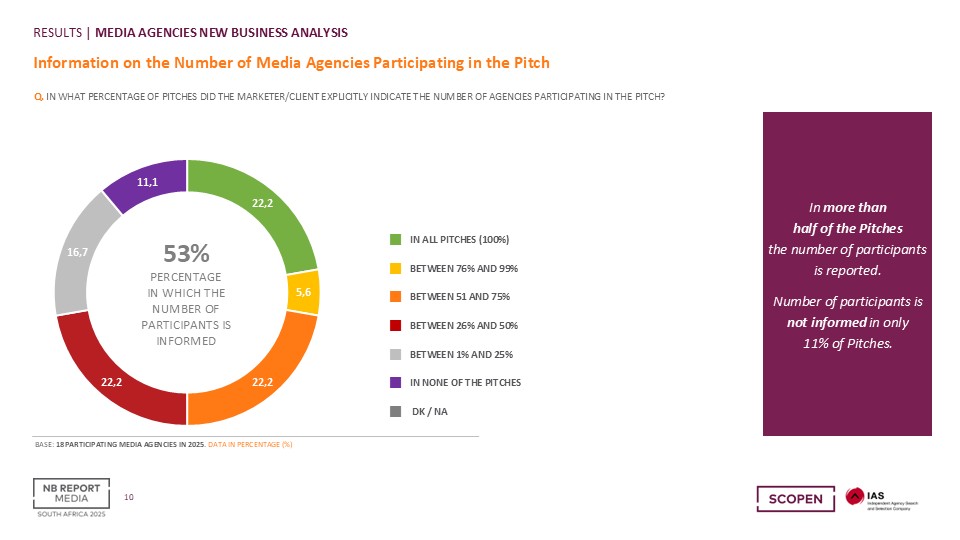

- In South Africa, advertisers disclosed the number of competing companies in 53% of pitches.

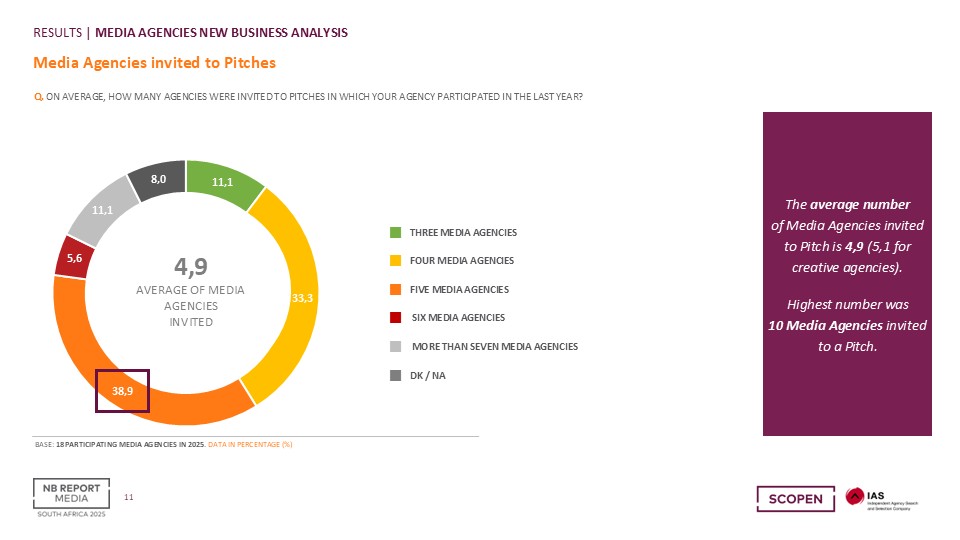

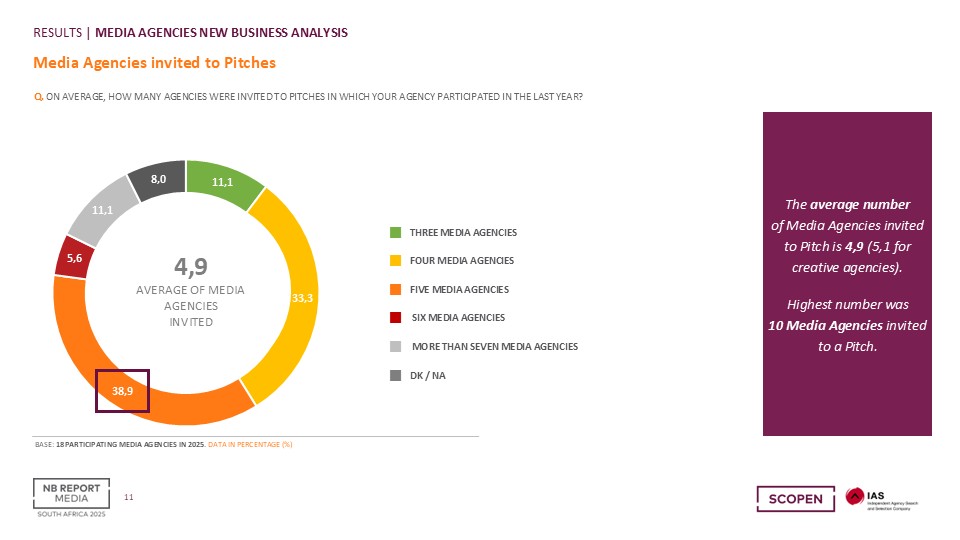

- The average number of invited agencies per pitch was 4.9.

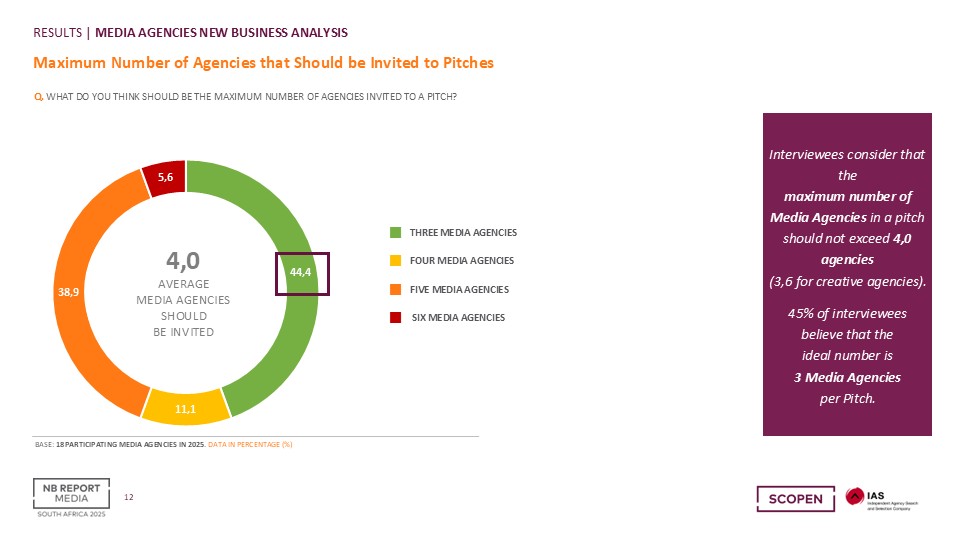

- Agencies believe, on average, the ideal number should be capped at three.

Pitch timelines

From the initial brief to the final decision.

- Average pitch duration: 2.7 months.

- Advertisers typically give media companies four weeks to submit final pitch proposals after receiving the brief.

Remuneration of pitch processes

- 12% of media pitches in South Africa were remunerated last year.

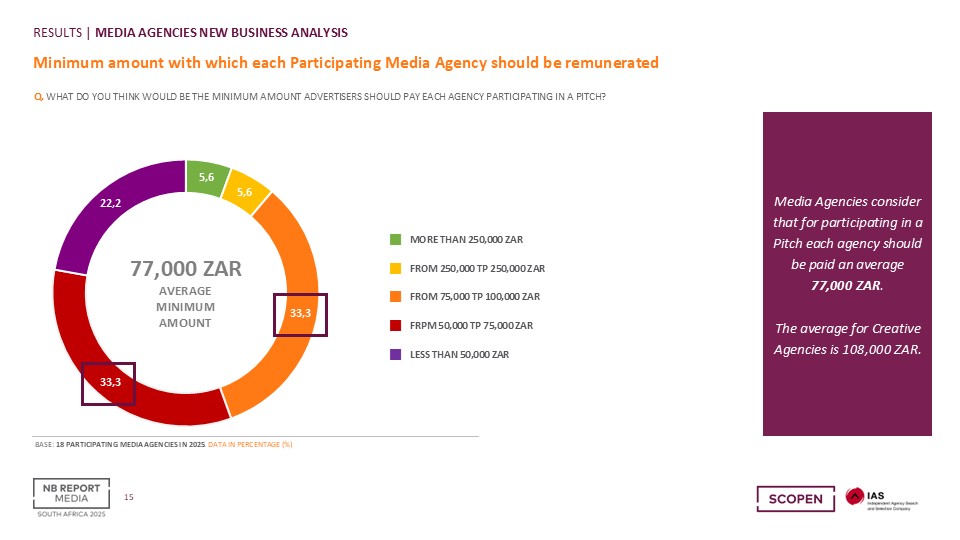

- Media agencies believe R77 000 is the minimum fair remuneration for pitch participation.

Investment in new business

- South African media agencies invest an average of R1.1 million annually in new business.

Johanna McDowell, CEO of the Independent Agency Search & Selection Company (IAS) and SCOPEN partner, commented, “I was surprised by the high number of pitches agencies are involved in—it doesn’t seem sustainable in the long run,” she said.

“Would the 14% conversion rate improve if media agencies were more selective?” she questioned. “It might be a smarter strategy to focus on the right opportunities rather than pitching for everything. Just because an agency is invited doesn’t mean they have to say yes.”

Read more: NEW BUSINESS REPORT SA 2025 – MEDIA AGENCIES slides

The Independent Agency Search and Selection Company (IAS) in association with the AAR Group (UK) was founded in South Africa in 2006. IAS specialises in client/agency relationship management and helping clients find agencies. The Independent Agency Search & Selection Company is committed to the international and local pitch guidelines as defined by both the IPA (Institute of Practitioners in Advertising UK) and the ACA (The Association of Communications Agencies SA).

SCOPEN Africa was launched in South Africa in 2015 in partnership with the Independent Agency Search & Selection Company. For information on SCOPEN Africa please visit scopen.com. AGENCY SCOPE 2025/26 will be the sixth edition of the study since 2016.