South Africa’s national savings month arrives this July, in another year with the economy still grinding in low gear and unrelenting global uncertainties. For those managing to save and invest, the challenge is staying the course to ensure long-term financial health.

According to the BrandMapp 2024 dataset, 80% of the country’s consumer class has savings and/or investments. The annual survey describes the 13.5 million South African adults living in households with a R10k+ monthly income, covering 100% of the taxpayer base.

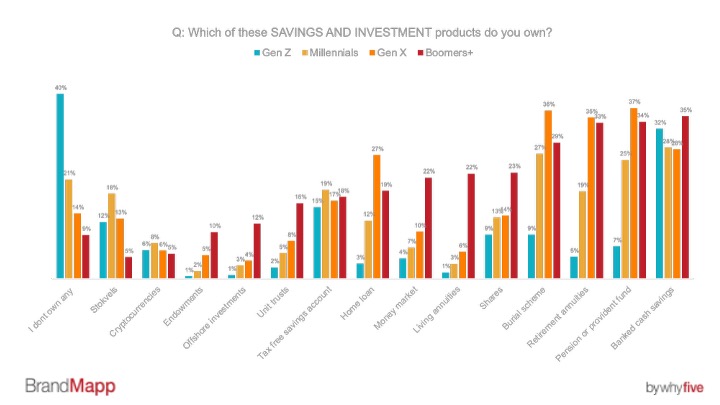

Brandon de Kock, BrandMapp’s director of storytelling says, “In many ways, the savings journeys we have mapped are what you would typically expect of the educated, employed mass market at their different stages of life.

Your savings and investments are all about your financial capabilities. And so, it’s not surprising that the younger generations, just setting out on the journey, have simpler portfolios, while those of the older generations are more diverse and sophisticated.”

Cash, saved in the bank, is king for SA taxpayers

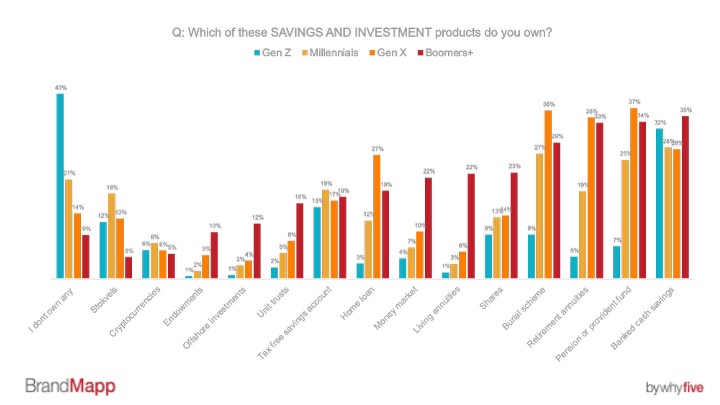

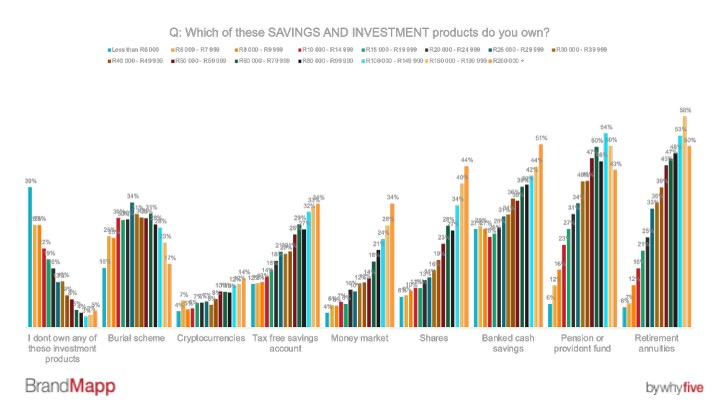

When it comes to deciding how to save, the most popular choice is banked savings. 30% of the consumer class have money in the bank that is kept aside from their monthly cashflow. It’s appealing to both young and old, with 32% of Gen Z and 35% of Boomers opting for banked savings.

De Kock says, “This is interesting if you are an investment house because it means that money in the bank is your biggest competitor. Perhaps, this is just a natural human response to the current upheavals in markets, and a reflection of today’s high level of consumer uncertainty. It’s the financial equivalent of food in the freezer!”

Burial schemes (28%), pension and provident funds (28%) and retirement annuities (24%) are also top saving and investment channels. 18% of the consumer class have tax-free savings accounts and 10% are saving in money market accounts.

Tradition vs tech-driven investing

A relatively small group of 14% of the consumer class invests in shares and 7% in unit trusts. There’s also 7% investing in cryptocurrencies.

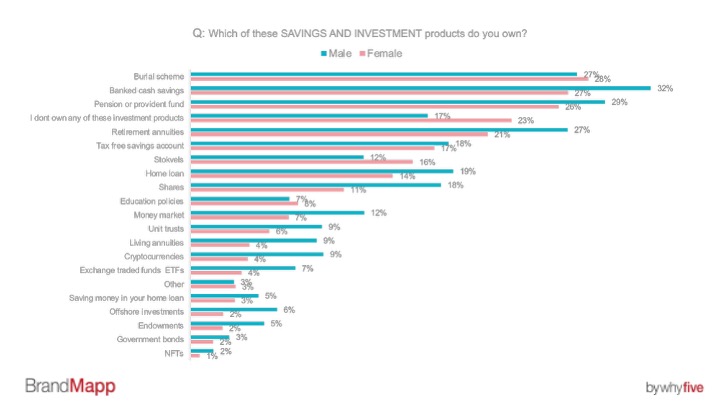

De Kock says, “The picture that we get from the data is that investing in crypto, at this time, is more of a gamble, a bet on the future, than an investment. It’s very youth-oriented, dominated by Millennials and dramatically skews male, with men more than twice as likely to have crypto than women.”

Stokvels have evolved

Once a community-based resilience savings tool for the working class, stokvels are still a feature of the South African savings and investment landscape, and a significant choice for 14% of the country’s mid-to-top income earners.

De Kock says, “This is most likely because, over the past decades, stokvels have evolved considerably with major banks offering stokvel‑specific accounts, insurance perks, digital tools and secure banking. Some of today’s stokvels also include investment components, so the purpose of the association is not necessarily just saving for emergencies. Stokvels are one of the few savings and investment vehicles where women are more likely than men to be invested.”

Saving and investing in South Africa reflects both the resilience and adaptation of the country’s mid-to-top earners.

De Kock concludes, “There’s no doubt that the majority of people living in South Africa – the millions who live in households earning less than R10K per month – are constantly in ‘survivor mode’ and it’s a struggle to just put food on the table. But what the data shows is that if you’re fortunate enough to have a job and you do have money left over once you have made ends meet, the inclination is to save or invest.

“Whether rooted in tradition or embracing digital channels, we are seeing a consumer class that is finding ways to move forward in saving and investing, even if it’s along an economic road that is rocky.”

BrandMapp 2024 insights are now available directly from the BrandMapp team at WhyFive Insights and by subscription via Telmar, Softcopy, Nielsen and Eighty20. For data access email Julie-anne@whyfive.co.za. Visit www.Whyfive.co.za for an overview of what’s in the new data.