Communication, transparency, and stakeholder inclusivity remain key BRC priorities as we continue to navigate the unique and complex South African media landscape.

‘Turbulence’ describes a period characterised by instability, uncertainty, unpredictability and significant disruption.

One could argue that the South African media landscape is the most turbulent in the world for a variety of reasons. Where else is there a melting pot of load shedding, an analogue switch-off and an influx of new digital platforms off the back of a pandemic?

Load shedding has of course dissipated, leading up to the 29 May election in South Africa, but I doubt it is over. We certainly cannot discount its effect on media consumption, particularly when it comes to television viewing.

Load shedding, just like Covid-19, forces a change in habits across the spectrum of chores, work, down-time, and entertainment. Just because your water gets switched off, doesn’t mean your thirst goes away.

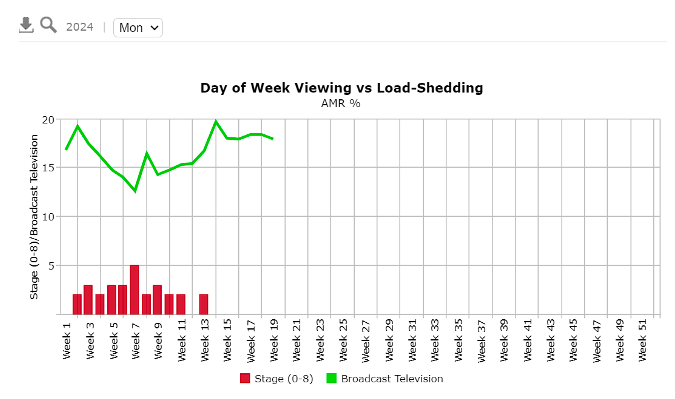

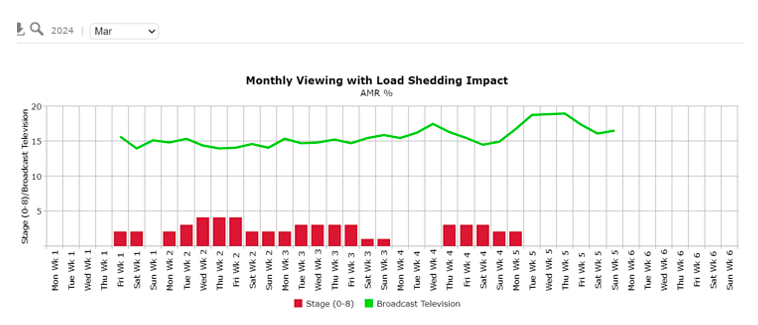

The same is true for television viewing in South Africa. As load shedding levels increase, the average amount of minutes viewing television decreases and vice versa.

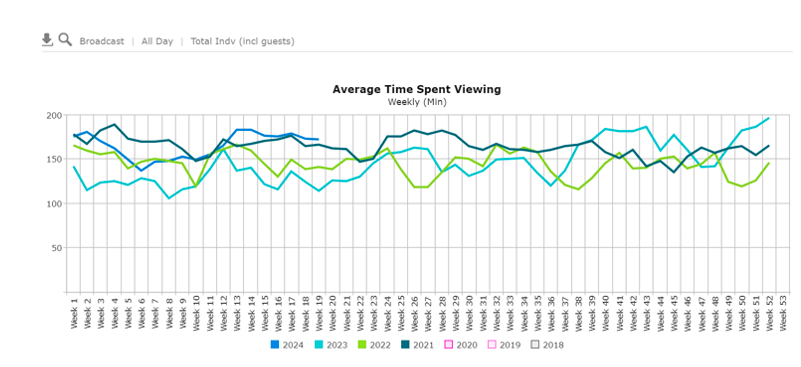

In the chart below we see that average time spent viewing is at an all-time high compared to the preceding three years.

As the stage of load shedding increases, the average minute rating decreases, but quickly returns once load shedding eases:

From experience, the South African spirit is one of always ‘making a plan’. Where there is a will, there is a way. When it comes to media and entertainment South Africans certainly have the will. When the lights go off, the television sets do too, unless you have back-up power.

Mobile steps in

For most South Africans, the luxury of a generator, inverter or solar power system is not a reality, so what do they do? They turn to their mobile devices to get their video/audio fix. The Television Audience Measurement Survey (TAMS) solely measures viewership on household televisions.

This begs the question: How do we know that mobile devices are being used for video content when the power goes out?

TAMS measures two specific non-broadcast activities:

- Usage of non-broadcast devices – any activity that is viewed on a television set via a separate device such as an Xbox, computer, or USB stick.

- Non-referenced viewing – any content that is aired/streamed directly onto a television set and is not monitored by the Broadcast Research Council of South Africa (BRC). This includes content viewed on Netflix, Showmax, YouTube and the like.

Of these two activities, the usage of non-broadcast devices is the highest at roughly 15% (average minute rating per day (AMR) and continues to grow year-on-year.

Viewed at source

Non-referenced viewing remains fairly stable year on year and is just below 10% (AMR). The inference is that the habit of using another device for media consumption is rising, whilst the amount of non-broadcast/referenced content is flat.

When the electricity turns off, instead of casting content, via another device, onto a television, it stands to reason that the content will simply be viewed at source, which could be a mobile phone, laptop, or tablet. The audience is not going anywhere, what is changing is where they are viewing content.

The BRC is currently in the process of implementing a Software Development Kit (SDK) in order to measure streaming activity on alternative devices and out-of-home viewing.

TAMS challenges

The Radio Audience Measurement Survey (RAMS Amplify) is far more resilient to the measurement challenge currently faced by TAMS. It relies on claimed data over a twenty-four-month period rather than passive, second by second automated data.

Having said that, RAMS Amplify is not immune to market conditions and is faced with the challenge of older data remaining in the dataset. This means that listening habits that formed as a result of the Covid-19 restrictions still linger in the current dataset.

As the data is rolled (i.e. the oldest data (spanning a three-month period) is removed, and the most recent data (spanning a three-month period) is included), which results in a decrease in audience size in most cases.

This is a unique situation because the individual stations may be growing but are unable recreate a scenario, such as Covid-19, that keeps South Africans glued to their radios for updates on the pandemic and therefore grow enough to surpass the gains of two years ago that are gradually removed from the dataset. As data is released to the market each quarter, we lose some of those Covid-19 gains.

Trusted radio

Radio remains a trusted companion in a world where fake news is spoken about constantly. To this end, the BRC is exploring the addition of ‘need-states’ to RAMS Amplify.

By incorporating need-states into RAMS Amplify, broadcasters and advertisers can gain a more nuanced understanding of their audience, leading to more effective programming and targeted advertising strategies.

By understanding and addressing the underlying motivations for radio consumption, stations can enhance content relevance, improve listener engagement, and achieve more effective advertising outcomes, ultimately driving greater stakeholder success in a competitive media landscape.

We continue to see a move away from working at home, which no doubt influences radio listening habits. As per the most recent Infinite Dial study, which covers the major metropolitan population of South Africa only, we have seen increases across the board for digital audio.

Resilient to changes

The likes of podcasts, streaming radio and purchasing a smart speaker have all grown over a short period of time. Again, RAMS Amplify is resilient to these changes as respondents are asked about their listening habits regardless of devices used.

As this is claimed data, the BRC is investigating an SDK implementation for RAMS Amplify with the aim of establishing streaming figures for the radio stations, which compliments current RAMS Amplify data.

Overcoming turbulent market conditions involves a strategic and resilient approach. Currency research, now more than ever, must remain adaptable and flexible with a long-term vision made real by actionable aligned short-term actions.

Communication, transparency, and stakeholder inclusivity remain key BRC priorities as we continue to navigate the unique and complex South African media landscape.

Gary Whitaker boasts over two decades of expertise spanning market research, media strategy, and both traditional and digital marketing. His journey began with a focus on comprehensive market research roles at ACNielsen and Millward Brown. Driven by a passion for the media sector, Whitaker is committed to fostering profound consumer insights that underpin strategic decision-making across agency and corporate landscapes. He places paramount importance on data integrity and meticulous planning. Renowned for his lateral thinking and solution-oriented approach, Whitaker’s appointment as CEO of the BRC marks the culmination of his versatile, self-directed career and his unwavering dedication to driving meaningful impact.

Gary Whitaker boasts over two decades of expertise spanning market research, media strategy, and both traditional and digital marketing. His journey began with a focus on comprehensive market research roles at ACNielsen and Millward Brown. Driven by a passion for the media sector, Whitaker is committed to fostering profound consumer insights that underpin strategic decision-making across agency and corporate landscapes. He places paramount importance on data integrity and meticulous planning. Renowned for his lateral thinking and solution-oriented approach, Whitaker’s appointment as CEO of the BRC marks the culmination of his versatile, self-directed career and his unwavering dedication to driving meaningful impact.